Over the past couple of months, Non-Fungible Tokens (NFTs) became extremely popular for selling digital assets. NFT are crypto tokens that use blockchain technology to prove the authenticity and ownership of a unique digital asset. NFT solve one of the main pain points of digital assets: they tend to be interchangeable with another identical asset, i.e. fungible. Most digital products such as song, ebook, picture, etc.. have always been fungible as they can be easily copied multiple times, and consumer doesn’t care which copy they are using.

NFTs solve this predicament by permanently associating a uniqueID into a token representing a specific version or copy of assets. The act of creating this ID and permanently biding it is called minting. This process uses cryptocurrency to generate a crypto token on a blockchain. This token becomes the equivalent of a passport for the digital asset. It enables users to see and verify its entire history (ownership, creator, price) without the need for an intermediary.

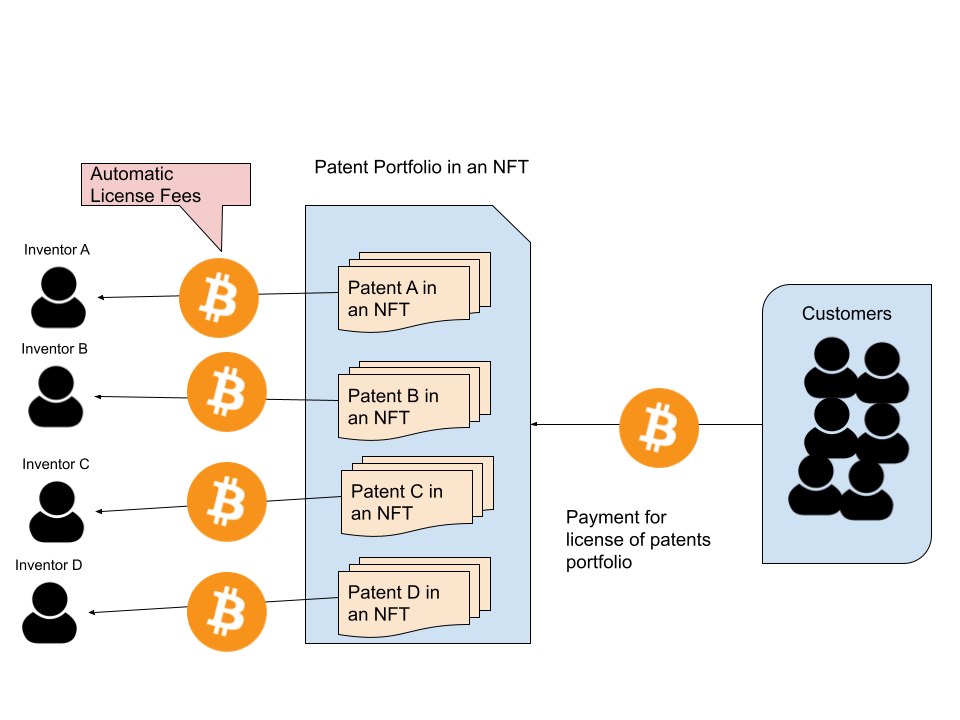

Patent owners stand to benefit from such innovation. It would allow them to ‘tokenize’ their patents. The obvious benefit would be making it much easier to track patent ownership changes since every transaction will be stored on a blockchain. However, NFT would also facilitate the revenue generation of patents by democratizing patent licensing via NFT. NFTs enable the intellectual property economy by embedding automatic royalty collection mechanisms within inventors work, giving them financial upside whenever their invention is licensed. One such form would be the generation of patent portfolio pooling and empowering. For example, each inventor would mint their patent into an NFT (ERC1155-backed), and these NFTs would be grouped to form the commercial IP portfolio and minted in a compounded NFT (ERC721-backed). Whenever the licensing revenue is generated, each inventor would automatically get their fair share of royalties without tracking them down. This approach would drastically change the balance of power as small inventors would merge their IP assets in a viable portfolio without losing their rights.

Obviously, there are some roadblocks. Most blockchains use a proof-of-work protocol to verify and confirm the validity of transactions. Proof of work requires significant electricity consumption and carbon emissions to sustain blockchain operations. Etherum is trying to alleviate this by switching to a proof of stake approach. Beyond emissions, the fees of minting and trading an NFT are also high. Artists generally pay more than $100 to mint an NFT, and buyers pay high transaction fees.

Regardless of these issues, NFT has considerable potential in the intellectual property domain. It can bring more transparency, increase liquidity, and open the market to inventors who typically had difficulty generating revenue from their inventions.

June 21, 2021